Last time, I looked at Amazon’s approaches to video game hardware, software, and retail. In this post, I’m turning to the company’s live-streaming video subsidiary, Twitch, and its connection to the larger Amazon ecosystem. This post adapts a chapter from Denise Mann’s upcoming anthology Content Wars: Tech Empires vs. Media Empires, in which I argue that Twitch plays a vital role in supporting Amazon’s self-sustaining platform. Here, I present a brief overview of how Twitch has supported Amazon Studios (i.e., film and TV), the core Amazon ecommerce business, and Amazon Game Studios.

Since buying Twitch in 2014 for $1.1 billion, Amazon has transitioned the subsidiary from an autonomous part, or plank, of its platform to a more synergistic contributor. While analysts and journalists originally questioned Amazon’s decision, Twitch has provided a highly engaged, and growing, audience. In fact, Twitch’s monthly viewer count has nearly tripled from 55 million at the time of the deal to over 140 million in 2018.

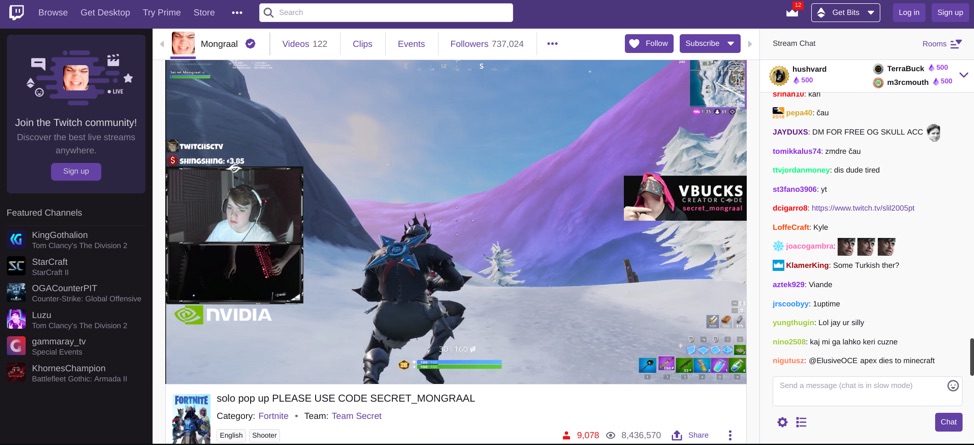

Twitch has cultivated a dedicated user base around its content, in which broadcasters narrate over gameplay and interact with viewers via live chat (see Figure 1). This live-chat function remains Twitch’s main selling point against rivals like Microsoft’s Mixer, Google’s YouTube Gaming, and Facebook’s Fb.gg. Even before these other services appeared, Twitch had established a dedicated live-chat language and culture based on emotes, emoji-like images imbued with meaning (e.g., the “Kappa” emote expresses sarcasm). In 2015, Twitch expanded into non-gaming verticals. Both Twitch Creative (i.e., art) and Twitch Food (i.e., cooking) launched with marathons of licensed, kitsch TV series—Bob Ross’s The Joy of Painting and Julia Child’s The French Chef, respectively. Similar content has appeared since this time (e.g., Power Rangers in 2017 and Pokémon in 2018) with impressive results.

Figure 1: Twitch’s user interface, displaying a livestream of user Mongraal.

In addition to featuring niche, licensed programming, Twitch has presented Amazon Studios series. In 2016, Twitch streamed the pilots for Amazon Studios’s The Tick (2016-Present) and Jean-Claude Van Johnson (2016-2018). Both programs complemented Twitch’s kitsch licensed content, with the former based on a campy comic book character and the latter a self-referential comedy featuring action star Jean-Claude Van Damme as an exaggerated version of himself. During the streams, the channel TwitchPresents ran each pilot, while the live-chat and a survey collected feedback. For Amazon, showcasing its TV series on Twitch helps reach the young male demographic that tends to be resistant to advertising but passionate about their fandom; in fact, Twitch claims 81.5% of users are male, 55% of which are between the ages of 18-34. With data from its highly engaged users, Twitch can guide Amazon Studios’s creative and marketing decisions. Beyond licensed and original programming, Twitch also has supported Amazon’s live TV initiative. After experimenting with broadcasts of minor league NBA G-League games, Twitch has featured Thursday Night Football matches in a partnership with the NFL (in 2018, Tyler “Ninja” Blevins and other popular broadcasters even provided commentary for a game). All of this suggests that Twitch serves a similar function for Amazon Studios as Twitter does for TV networks: providing audience data insights through real-time reactions.

Twitch broadcasters also encourage audiences to remain on the Amazon platform. As Amazon Studios moves into more mainstream, franchisable content (e.g., the upcoming Lord of the Rings TV series, as profiled in my first post), Twitch will continue to provide valuable audience insights and link to Amazon’s ecommerce business. Amazon already sells exclusive licensed merchandise based on its children’s programming, such as Tumble Leaf plush toys; through integration with Twitch, Amazon can direct audiences to buy exclusive Lord of the Rings merchandise, for instance. Since 2017, viewers can directly purchase live-streamed games (through Twitch Games Commerce) and other products (through the Amazon Gear Extension). Encouraging online retail sales represents Amazon’s main priority, given that ecommerce—along with the Amazon Web Services cloud storage business—drives the majority of profits.

Lastly, Twitch has supported Amazon’s video game strategy. The proprietary Lumberyard video game engine, for example, includes built-in Twitch integration and can be licensed to external developers. Furthermore, Amazon Game Studios (profiled in the previous blog post) has integrated Twitch capabilities into its line of software. By teaming Twitch with Amazon Web Services and Amazon Game Studios, Amazon can more strategically position its Fire TV hardware as a gaming system (even after dropping Fire TV controller support, Amazon continues to bring games to the hardware). This can further encourage time spent on the platform and, by extension, the likelihood of ecommerce transactions.

In sum, by using Twitch to support other planks, Amazon demonstrates the advantages that the platform economy holds over legacy media industry players (e.g., Hollywood film and TV studios). The next blog post will look at the involvement of these legacy players in the larger esports (i.e., competitive video gaming) market.